Have you ever wondered what would happen if hackers got into your bank account? What if YOUR BANK ITSELF let someone into your account? While hackers may be scary, the scarier prospect is your bank’s online system allowing access to random people.

As of this afternoon, that’s actually what happened to my fiancee. According to the Customer Service Representative we spoke with, it’s been happening to other people today as well.

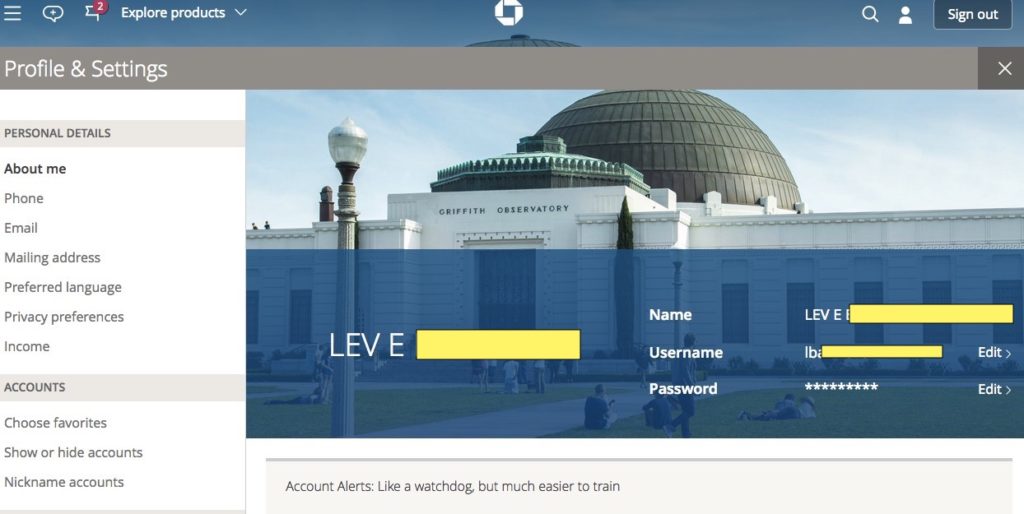

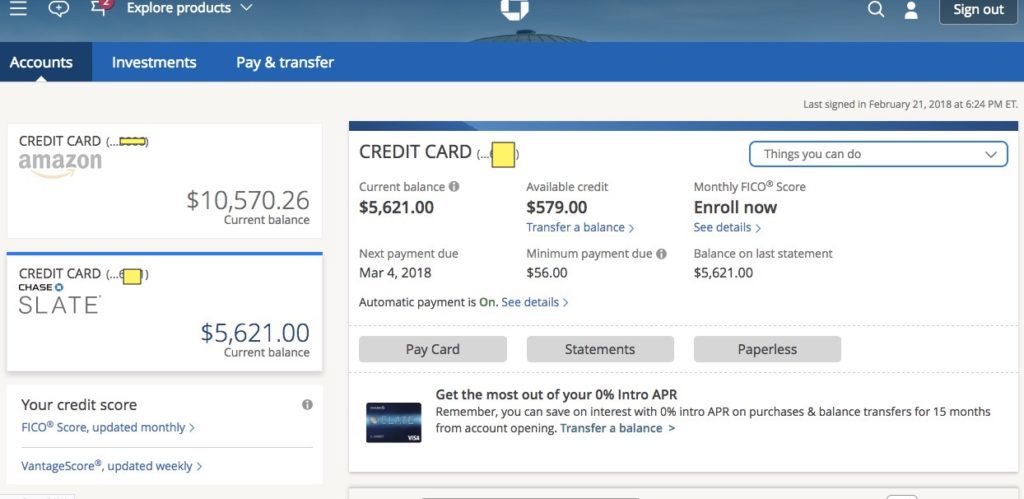

Here’s what happened: We’ve been doing our taxes all day and Lady Fly&Dine had to check her Year-End Statement on one of her Chase cards. She used the same credentials she always uses but instead of landing in her account, she wound up in the account of a guy from New Jersey. We could see his credit cards, his login details, his addresses, his phone numbers, and every other piece of sensitive information that’s lurking in your online bank account. Sorry, Lev, but you might want to call Chase if you recognize this account…

We immediately called Chase to alert them of the problem and the Customer Service Rep didn’t even seem that concerned. In fact, he said that other people had been calling in with this issue today, too, and jokingly speculated that “someone was going to have a bad night.” Luckily for our friend Lev (or unluckily as the case may be), he only has two credit card accounts and they both have balances to be paid. If he — or anyone else — had checking or savings accounts, though, whomever got access to the account could simply transfer it out using Quickpay and then *poof!* the cash would be gone forever. What a nightmare.

Hopefully Chase recognizes how absolutely serious this problem is for them and their customers. I imagine it’s one of the biggest worries that bankers had when online banking began. If our money isn’t safe in our online accounts, we’re going to all have to start thinking about a better way to store our savings. Bitcoin? Gold bars? Is a new banking future on the horizon? All I know is that I hope Chase fixes this FAST.

Happened to me too… The accounts I saw were unfortunately past due credit cards….

And their idiot CEO wants to run for President in 2020

As long as the law allows it, when given the choice between protecting the public versus increasing their bottom line, banks will continue to choose the latter.

Last year Synchronicity Bank instantly issued credit cards on line in my name to a bad guy who used my stolen identity. Included in the credit application was my home phone number. Had Synchronicity called me before issuing cards; the bad actor would have been stopped dead in his tracks.

A few weeks after the cards were issued an out-of-state merchant suspecting credit card fraud googled me. Unfortunately for the bad actor I’m the only person on the planet with my name. The merchant found my phone number in less than two minutes. Because he was responsible enough to call me I learned that Synchronicity Bank had issued bogus credit cards bearing my name and they were being used to make fraudulent transactions all up and down the Eastern Seaboard.

Until we have laws to stop them, banks will continue to operate at the speed of light, putting profits ahead of protecting the public, and leaving us to clean up the mess.

I have been with chase a long time during which i have seen their customer service decline massively.

Do I or don’t I sign into my account to see if this has happened to me?

They claim that they fixed the issue, so I think it’s safe to sign in now.

This just happened to me last week. They opened a new account for me and it happened again to an account that I never used.

I referred a friend to Chase credit card and Chase decided to insert his mother’s cell number into the security verification upon logon. They also added her security questions and his brother’s (who doesn’t even live at that address for like 20 years) as his security questions!!! His mother lives at the same address and has a Chase account… He called 3 times and they switch him from the online support to the online fraud team each time and can’t seem to reset this so he can login to his new account!!! Scary stuff!